Mortality Screening

Enhance your scheme integrity with mortality screening, helping you identify potential mortality cases. Promptly. Accurately. Confidently.

Request a consultation

Swift and accurate results

Our Mortality Screening service is the ultimate solution for pension schemes seeking precise and prompt results. It empowers pension schemes to maintain fully up-to-date records - with minimum effort and maximum accuracy.

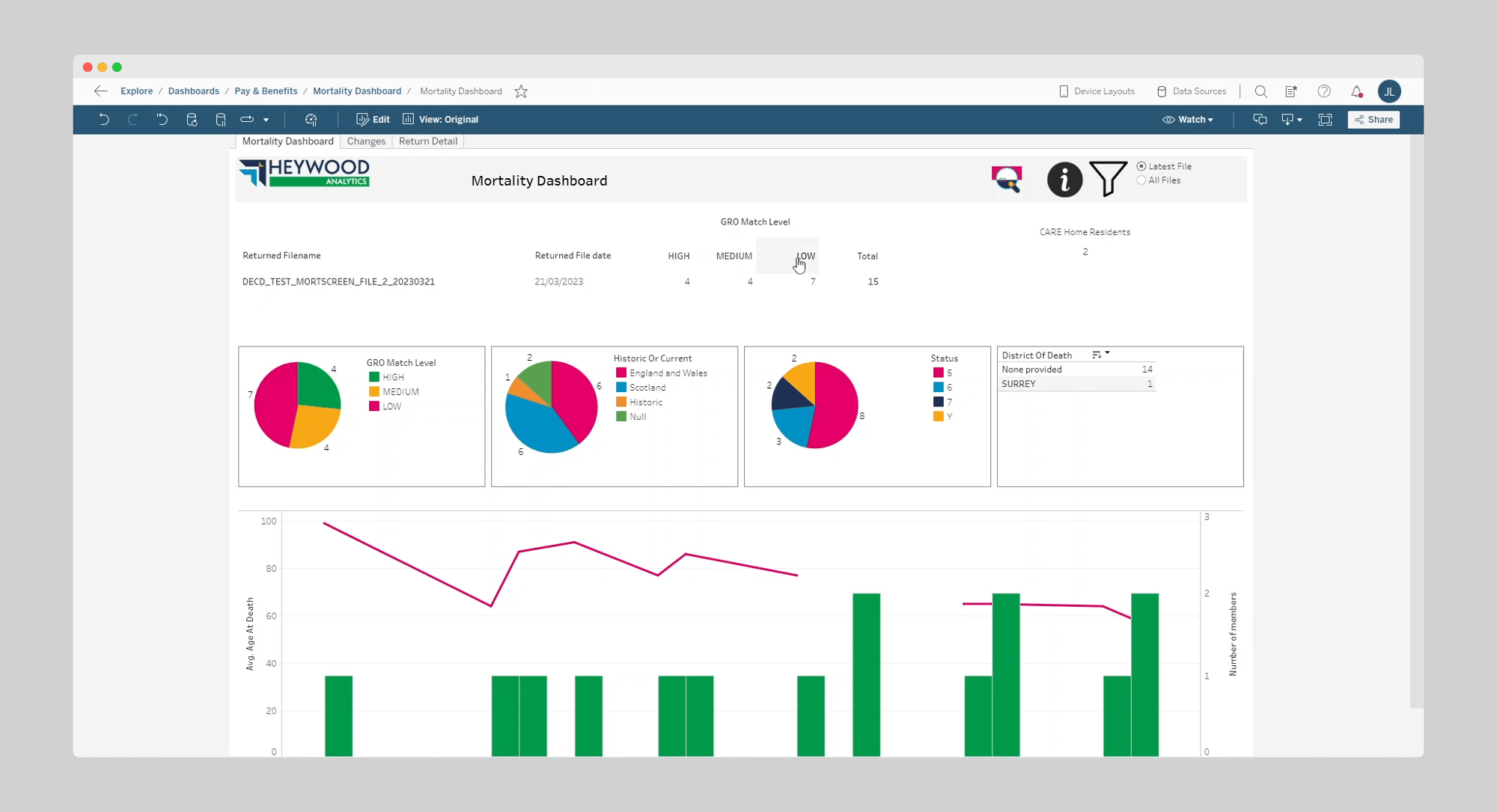

The process is automated through our Managed File Transfer (MFT) solution, collecting and returning data seamlessly to your system. Our Insights dashboard offers valuable data analysis, and a fresh perspective on your data.

The process is automated through our Managed File Transfer (MFT) solution, collecting and returning data seamlessly to your system. Our Insights dashboard offers valuable data analysis, and a fresh perspective on your data.

Enabling confident decision-making

Our mortality service will ensure your records are always up to date.

- Diverse data sources

Identify potential mortality cases using a diverse range of data sources, including the General Register's Office Disclosure of Death Registration Information and the National Deceased Register. - Regular weekly updates

Our service offers granular mortality indication levels, provided weekly if required. Keeping your records up to date, and preventing overpayments. - Customisable insights dashboards

Insights dashboards offer customisable visual analytics, easy data interrogation, and effortless information export. Automate reports and alerts at the click of a button. - Prevent overpayments

Safeguard your financial health and reputation by mitigating the risks of pension payment fraud and accidental overpayments.

Reasons to choose our Mortality Screening service

Discover how our service has been designed to strengthen your scheme’s integrity.

Automated processes

By automating the mortality screening process, you’ll significantly reduce administration time and associated costs.

Accurate identification

Accurately identify potential mortality cases to ensure prompt action, and drive down the risk of pension overpayments.

Reduced fraud risk

Reduced risk of fraud and data protection breaches protects the fund's reputation and gives members greater confidence in the security of their pension data.

Validated member data

Accurate member data, validated through mortality screening, directly contributes to the precision of scheme valuations.

Auditable results

The service delivers compliant, auditable results that support your payroll cycle and improve scheme accuracy.

Specifically designed for your needs

Heywood’s Mortality Screening Service has been specifically designed to address the needs and responsibilities of pension scheme trustees and administrators. It provides an accurate, cost-effective, and secure method of validating potential mortality cases across the deferred and pensioner membership.

Heywood ensures secure and accurate pension payments. Our solutions mitigate fraud and overpayments, including IOD (impersonation of the deceased) and recovery. You can rely on us to keep your data precisely up to date.

Heywood ensures secure and accurate pension payments. Our solutions mitigate fraud and overpayments, including IOD (impersonation of the deceased) and recovery. You can rely on us to keep your data precisely up to date.

Torfaen CBC has been submitting a monthly mortality screen check to Heywood since December 2010. The process of sending and receiving the files is quick and straightforward and the results are received promptly.”

-

Assistant Pensions Manager

Torfaen County Borough Council

.png)

Data services resources

Giving you the insider view on all the latest industry developments, and expert intelligence on the news that matters.

Data Services

From data burden to data asset: Why accurate PII is essential for pension schemes

06

November,

2024

Pension risk transfer

Pensions Risk Transfers: What value does residual risk insurance bring to schemes?

03

October,

2024

Who we work with

Our customer list speaks for itself. At Heywood, we believe a true partnership is a two-way street. Mutual trust and respect are at the core of every interaction. And that’s why we enjoy long-term partnerships with all of our customers.