A pioneer in transformational member experiences

North East Scotland Pension Fund

The North East Scotland Pension Fund (NESPF) is one of the largest Local Government Pension Schemes (LGPS) in Scotland, looking after 76,000 members and assets worth over £5.8bn.

NESPF administers the Fund for employees of Aberdeen City Council, Aberdeenshire Council and The Moray Council as well as around 40 other public or charitable bodies.

Overview

A leader in digital evolution, NESPF had already embraced Heywood’s Member Self-Service (MSS) platform in 2016, capturing the engagement of 60% active and 58% of deferred members.

In 2022, NESPF embarked on an internal administrative review, fueled by a desire to streamline processes, drive efficiency and further enhance online member services. On top of this, this digital-first mindset was the motivation to explore the use of robotics and automation to deliver a first-class member service.

As a result, NESPF sought to harness the power of Heywood's new transformational member experience platform, Engage, to elevate member experiences to unprecedented levels while providing increased peace of mind for users with strengthened security measures.

Driving innovative member engagement

Heywood’s groundbreaking new member engagement platform revolutionises how pension schemes connect with members and empowers them to confidently and securely oversee their pension information.

North East Scotland Pension Fund were one of the first to take advantage of this innovative new platform.

Solution overview:

- Tested on real user behaviour to deliver a first-class member experience.

- Tailor-made communication and other resources helps connect with members and boost engagement.

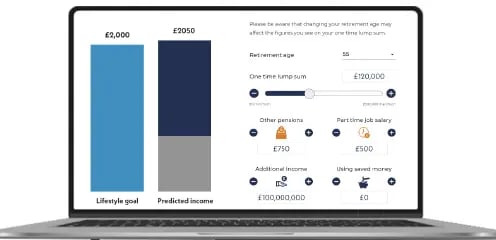

- Helpful forecasting tools help make retirement planning easy.

- Make complex stories simple with language members understand and video personalisation.

- Harness the power of an analytics suite that delivers valuable insights.

- A safe and secure environment for members to effortlessly access and manage their pension accounts.

The project

Having witnessed the potential of the new transformational member experience platform through User Groups, product demonstrations and workshops, NESPF wanted to be a pioneer.

The Fund were aware of the distinct advantages and potential of delivering more services online, however, were conscious that to do so they needed a solution that matched their ambition.

After close dialogue with Heywood’s Customer Relationship Manager, they volunteered to be an early adopter of the platform.

The decision to be an early adopter wasn't just about technology, it was about revolutionising member engagement.

Our approach

Close dialogue between NESPF and Heywood was a hallmark of the project. Regular communication and meetings helped the Fund examine the system in-depth, and delivered an understanding of how the platform worked, how it could fulfil their goal to support members and crucially, how it would impact members already using MSS.

Following a series of discussions, Heywood shared a proposal with NESPF which was subsequently agreed to and the implementation and delivery phase of the project commenced.

The implementation process involved a collaborative and hands-on approach with bi-weekly calls between the project teams at Heywood and NESPF scheduled to discuss developments, testing and overall progress of the project.

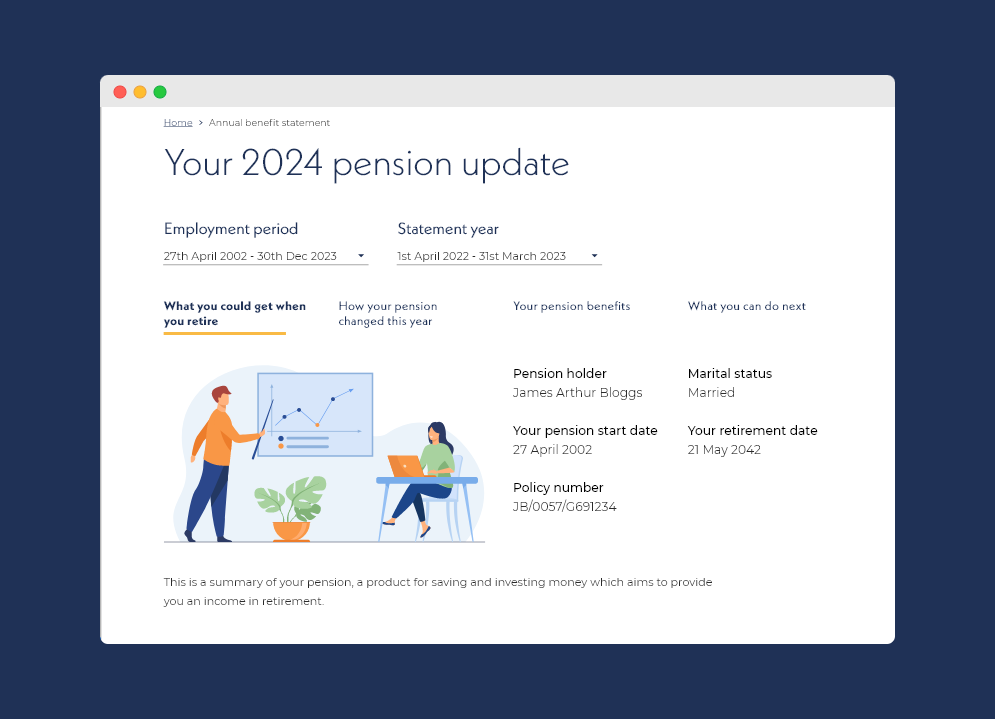

In March 2023, a 12-week User Acceptance Testing (UAT) phase kicked off to ensure delivery of the new platform ahead of issuing of Annual Benefit Statements (ABS) in July and August. Following this phase of significant testing, with staff training and member communication strategies finalised, NESPF went live with the new platform on 26 June 2023.

It was a journey, a collaboration and a testament to NESPF's commitment to delivering excellence.

The results

With deferred ABS due, the Fund opted for a soft launch whereby they publicised the portal through employers' internal communication channels. These communications detailed the additional benefits of their new site, now referred to as My Pension+, and explained how users could sign up or migrate to the new portal.

Despite a soft launch, the Fund had over 1,000 members sign up within the first two weeks and positively, there was no increase in calls or emails to their support helpline during this period.

The Fund successfully delivered deferred ABS within the platform and active members were provided with an engaging, easy to navigate and understand ABS webpage, with the additional feature of a personalised video ABS.

In the wake of NESPF's journey with Engage, by January 2024, six months after launch over 12,500 members had registered, with a remarkable 15% increase in site usage compared to the previous year.

In addition, providing a personalised video ABS to users has been a great way to engage with members and promote the portal. ABS video views totalled at over 3,500 by January 2024, each view not just a number but a member fully supported in their financial journey.

Member feedback has been overwhelmingly positive. With Fund branding applied to the portal it delivered a familiar feel whilst delivering an enhanced user-experience. Navigating pension information felt less like a task and more like a personalised financial journey.

Project snapshot

Custom branding

The platform was customised with the Fund’s branding, helping to retain a consistent look and feel.

12 week testing window

After a 12 week testing window, the Fund were ready to go live on 26 June 2023

15% increase

Year-on-year figures show a 15% increase in site usage

12,500 registered users

Over 10,000 users had registered to use the platform within six months of go-live

3,500 video ABS view

ABS Video views totalled at over 3,500 by January 2024

The North East Scotland Pension Fund Experience

Our new transformational member experience platform allows us to fulfil our administrative goals, as we look to expand our customer services and move to a digital-first strategy. As a Fund, it gives us the confidence to direct members to an intuitive and engaging site while it delivers a tailored and easy-to-use experience for members.

Throughout the process, Heywood has taken the time to understand our needs and fully embraced feedback, ensuring it meets our requirements and positively impacts our relationship with members."

- North East Scotland Pension Fund

.png)